Building a full fibre future: European fibre-to-the-premises (FTTP) investment trends 2021

Our new study, conducted in partnership with TMT Finance, indicates that the recent rise in FTTP investment is set to continue over the next two years. In a survey of senior executives across the investment, professional advisory and operator space within the fibre industry, 78% say they expect the overall value of investment will increase for FTTP projects in Europe over the next 24 months compared with the previous 24 months. The findings of the report are based on a combination of quantitative analysis and qualitative interviews.

Whilst COVID-19 restrictions have inevitably driven end-user demand due to a rise in working from home, the insight gathered through this report highlights other key factors for the rise and appeal of FTTP to investors, as well as the potential risks they see in this industry.

Other key findings:

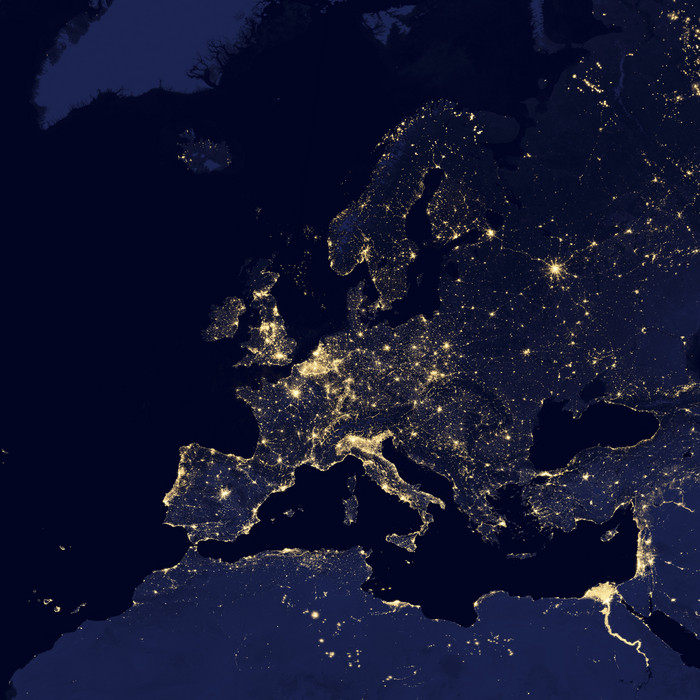

- Germany, the UK and Poland are seen as most attractive for European FTTP investment – 26% of respondents saw Germany as the country most attractive for FTTP investment, followed by the UK (21%) and Poland (15%).

- Infrastructure funds are expected to be the biggest FTTP investors over the next 24 months - 84% of respondents expect infrastructure funds to be the frontrunner in FTTP investment over the next 24 months, in line with the previous 24 months (84%). An expected increase is also predicted in investment from pension funds and other asset management firms, while a decrease is expected from telecom operators and private equity firms.

- Overbuilding is considered the biggest threat to FTTP building and investment - Risk of overbuild (40%), regulatory complexity (26%) and competition with other investors (26%) are rated the biggest obstacles to investing in FTTP in Europe.

In partnership with TMT Finance.