European Data Centre Investment Outlook: Opportunities and Risks in the Months Ahead

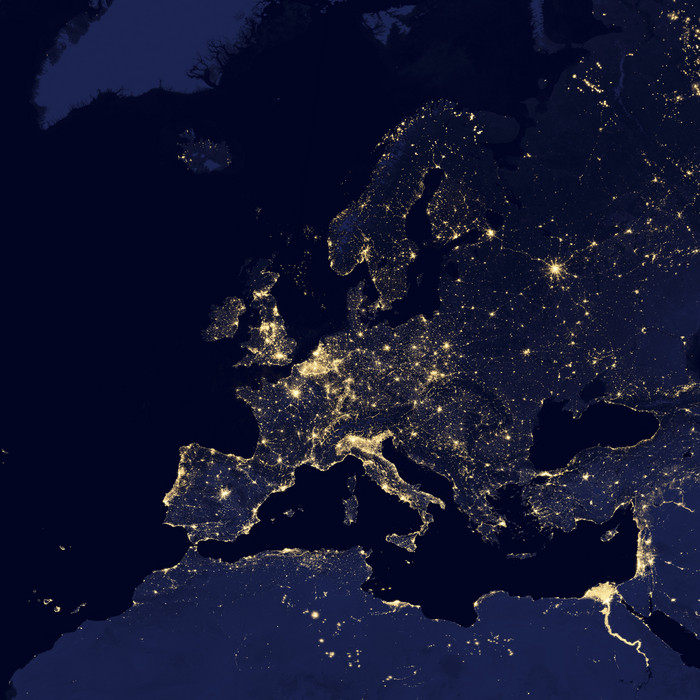

A new study by DLA Piper, in partnership with the Inframation Group, reveals that investors are overwhelmingly optimistic about the prospects for European data centres over the next two years.

In a survey of 50 senior Europe-based executives, 92% said they expected the overall value of investment into Europe's data centre infrastructure to increase over the next 24 months, compared with the previous 24 months.

This finding is backed up by Inframation Group figures, which show that European data centre transactions have risen dramatically since 2015, both in volume and value. And momentum is building - deals in 2018 exceeded EUR1.2 billion and figures for the first half of 2019 suggest another record year could be in sight. Factors behind this growth include the shift to cloud computing and colocation, which are transforming the way businesses consume IT.

Other key findings from the research include:

- Debt providers lead the charge: The survey reveals big differences between debt providers and equity investors in their outlook. Debt provider respondents state a combined increase of 33% in the total value of debt investment they expect to allocate to European data centres over the next 24 months, compared to what they allocated over the previous 24 months. Equity investors, on the other hand, expect a more modest increase of 18%.

- Brexit impact: 100% of respondents agree that Brexit uncertainty has negatively impacted the data centre infrastructure market in the UK and Europe since June 2016, with 56% of equity investors going as far as to say that the negative impact has been significant.

- Rents on the rise: Even for data centres with overall inferior technology (i.e. assets with low energy efficiency and poor environmental performance), two-thirds of all respondents expect average rent charges will either only decrease by up to 4% or remain unchanged by the end of 2019. 100% of respondents are expecting rent charges to increase for data centres with overall superior technology, with over a third expecting the increase to be 10% or more.

The full report can be downloaded by clicking the download link below.