European Offshore Wind – what does the future look like?

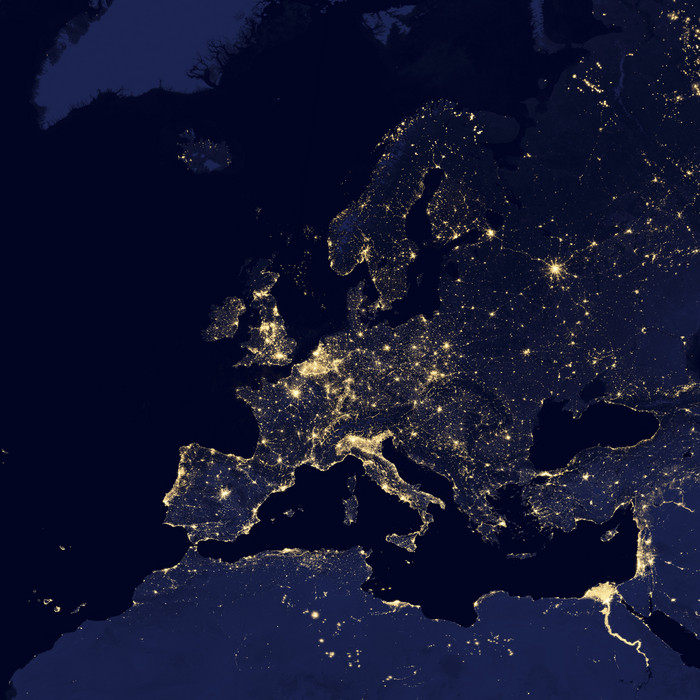

The story of offshore wind in Europe is remarkable by any standards. In the space of little more than a decade, some 4,500 turbines have been deployed across the North Sea, the Baltic and the Atlantic. Europe installed 2.6GW of new offshore wind energy capacity in 2018 alone. Subsidies have played a big part in getting the industry to where it is today. So has technology. The power output of individual turbines has doubled in the past five years. In the next five years, it is likely to double again.

The sector has also reaped the benefits of prolonged low interest rates, which have reduced the cost of debt financing. In parallel with this, offshore wind has been helped by rapidly changing investor appetites as both debt providers and equity investors have raced to meet sustainability targets. The maturity of the sector – and confidence in the technology – is attracting increasing numbers of new equity investors prepared to take construction risk. In parallel with this, opportunities are opening up in new geographies including Poland and Turkey. France, meanwhile, recently announced financial close of its first offshore wind farm.

In collaboration with Inframation, we take a look at the market activity, including volume of new build projects, investors’ expectations, M&A volume gap and value prospects. We also explore potential for choosing investment with review of best geographical opportunities and how they can translate into global capacity. Moreover, the report outlines future expectations together with regulatory landscape and journey towards subsidy-free energy sources.