Jonas Aartun

Jonas Aartun has broad experience with Norwegian and international tax law. He mainly assists clients in connection with mergers and acquisitions, reorganizations, finance structures and incentive schemes for management and key employees, including carried interest and earn-out models.

Jonas also provides general tax advice with main focus on corporate taxation, including equity/debt classifications, financial instruments, international tax treaties, transfer pricing and the special tax regimes for shipping and energy companies (hydropower and oil). He also assist clients in connection with tax audits and disputes with the Norwegian tax authorities.

"Highly Regarded" within "General corporate tax" and "Indirect tax".

Jonas is recommended for Tax by The Legal 500, 2024.

"Highly Regarded" within "General corporate tax" and "Indirect tax".

Jonas is recommended for Tax by The Legal 500, 2023.

"Highly Regarded" within "General corporate tax" and "Indirect tax".

Jonas is recommended for Tax by The Legal 500, 2022.

Jonas is recommended for Tax by The Legal 500, 2021.

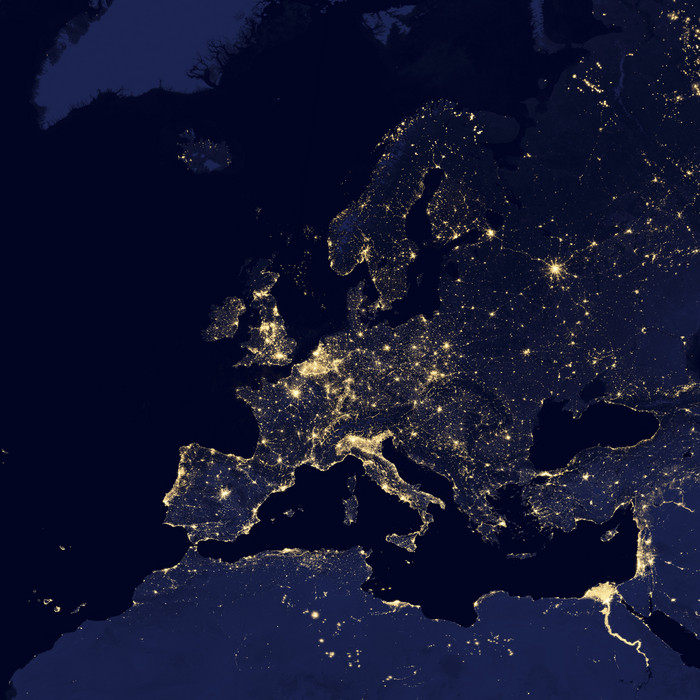

DLA Piper operates a cross-border Nordic tax department, with a focus on cross-border taxation work. The Norway team is specialised in assisting domestic and multinational corporations and real estate clients. Partner Preben Aas leads the department. He is supported by associate partner Jonas Aartun.

The firm is currently advising the Skanska Group on the direct and indirect taxes associated with a number of sales and acquisitions within Norway, as well as on Norwegian real estate tax. The firm has also represented former board of directors at AS Kraftsgate 2 in a court case alleging tax fraud against the directors, as well as business misconduct.

‘Jonas Aartun has unique insight into tax related matters, providing practical and specific advice.‘

Jonas is recommended for Tax by The Legal 500, 2020.