Competition law to your morning coffee – February 2023

In this newsletter, the competition law team at DLA Piper Norway provide insight to the latest and most relevant decisions form the EU, national courts, and competition authorities. The newsletter aims to provide a brief and easy-to-understand summary of current decisions and trends from the world of competition law, preferably as light reading material suited for your morning coffee.

On the 16th of February, the Norwegian competition law community could wake up to exciting news on the outcome of Norway's first merger case that has gone all the way to the Supreme Court (Nw. Høyesterett). The Court, as the Court of Appeal (Nw. Lagmannsretten), has concluded that the Norwegian Competition Authority's ban on Schibsted's acquisition of Nettbil must be overturned. After taking the case through all three instances in Norway, Schibsted has finally received a green light for the acquisition, which was originally completed in 2019. The Court bases its decision on the fact that there are several differences between the companies' products, especially a significant price difference. The Court therefore ruled that the companies' products do not operate in the same relevant product market, and that the threshold for authority intervention was not reached.

Awaiting a decision in Posten Norge's lawsuit against participants in the well-known EU truck cartel, and after the dairy producer Tine has submitted a compensation claim for the same matter, it is worth noting that the UK Competition Law Tribunal (CAT) on 7 February ruled in favor of the plaintiffs in the EU Commission's truck cartel case. The UK has thus received its first successful follow-on claim against a participant in the truck cartel. The CAT found that the infringement caused a financial loss to the claimants in the form of overcharging and ordered the DAF Group to pay approximately £17.5 million in damages to Royal Mail and three BT Group companies, including interest.

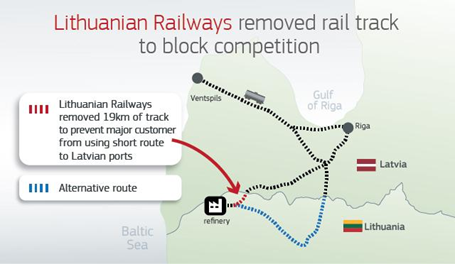

The image is taken from the website of the European Commission (Antitrust: Commission fines Lithuanian Railways €28 million (europa.eu)

The award for the most blatant push/abuse probably goes to Lithuanian Railways, for the dismantling of parts of the railway track in Lithuania to keep competitors out. The case was finally decided in the Court of Justice of the European Union on 12 January this year, where the court confirmed the General Court's judgment to impose a fine on the company for breach of applicable competition law rules. The Court concluded that the removal of the railway track did not have to meet the classic Bronner criteria (refusal to supply), but that it was sufficient to demonstrate that the conduct restricted competition and prevented access to the market. In other words, the removal of railway tracks by a dominant player was considered as a separate form of abuse, detached from and independent of the criteria linked to refusal of supply. The Court pointed out that the purpose of the criteria for refusal to supply is to establish a fair balance between effective competition and, on the other hand, contractual freedom for the dominant undertaking. These are not relevant criteria in a case where denial of access to critical infrastructure which the dominant undertaking neither owns nor has financed, but which has been paid for by public funds.

In case C-680/20 (Unilever), the Court of Justice of the European Union has come up with an important clarification in the wake of the Intel case, where it is now clear that the criteria laid down in the Intel case must also apply to exclusivity clauses. Although there is no by object vs. by effect assessment in cases of dominance, the Court lays down that one must have sufficiently clear empiricism/experience with similar abusive behavior to be able to assume that it potentially restricts competition in violation of Article 102 TFEU (the prohibition of abuse of dominant position). In other words, the Court highlights a certain evidentiary threshold that national competition authorities must conform to, in particular the duty to examine economic evidence that may indicate the opposite.

A step in the same direction is another recent decision by the Court of Justice of the European Union, HSBC Holdings vs. Commission (C-883/19 P), where the Court of Justice annulled the General Court's decision to fine the companies for attempting to rig Euribor interest rates, which provides a benchmark for interest rates on financial products. However, the decision that there was participation in a cartel remained. The Court annulled the fine based on the presumption of innocence, failure to safeguard the right of defense, and insufficient justification; the Commission should have considered the companies' arguments and evidence that the collaboration was not harmful to competition.

Regarding private enforcement of competition law, it can be mentioned that the Court of Justice of the European Union has again determined that a national court can order the release of evidence in connection with a claim for compensation related to an alleged infringement of competition law, even if the proceedings have been postponed due to the Commission's initiation of an investigation related to the same offence. This was recently established in case C-57/21 (RegioJet), which largely builds on the approach of greater transparency/publicity in C-163/21 (PACCAR). Decisive for the scope of the extradition obligation will have to be delimited according to the proportionality assessment, so there is reason to believe that the question will continue to be the subject to discussions in future trials before national courts.

The debate on sustainability considerations in competition law continues, and the CMA (Competition and Market Authority) has now also come up with its own guidance on how companies can collaborate on sustainability without ending up in conflict with the competition regulations. According to the director himself, CMA is very satisfied with the opportunity Brexit has given them to "take a fresh look at the guidance we give firms. This has given us the opportunity to go further than we have before in providing reassurance and clarity [...]". The revised horizontal guidelines of the CMA can be read here. Japan has also published draft guidelines (Green Guidelines) for how companies can cooperate for sustainability purposes without breaching competition law. The question is when or whether the Norwegian Competition Authority ever will dare to take the step and actively provide guidance to businesses on how the authority intends to assess the limits of sustainability cooperation.

Click here to receive our newsletter in your inbox.