Proposed significant changes to taxation of energy production and aquaculture

This morning the Norwegian Government held an unannounced press conference informing of a proposal to implement several new taxes related to energy production and aquaculture.

The initial key takeaways from the press release are:

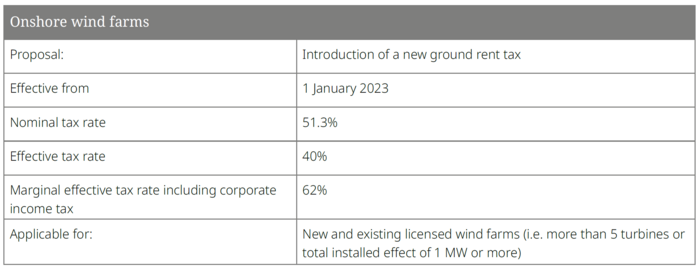

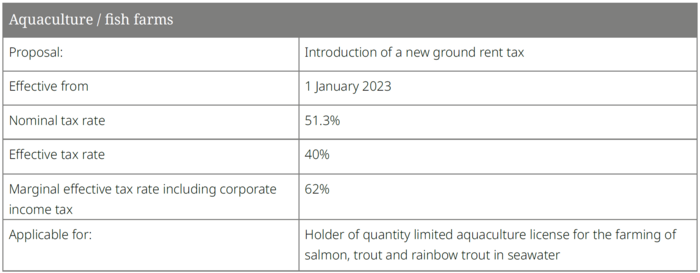

- Introduction of ground rent tax (Nw. grunnrenteskatt) on onshore wind farms and aquaculture/fish farms

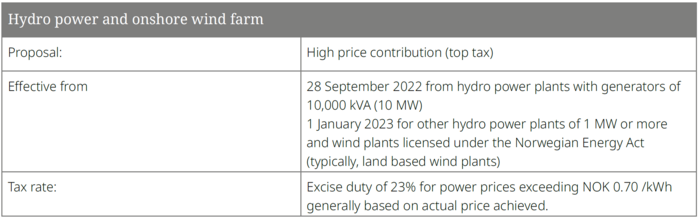

- Introduction of new top tax related to production from hydro power and onshore wind with a price exceeding NOK 0.70/kWh

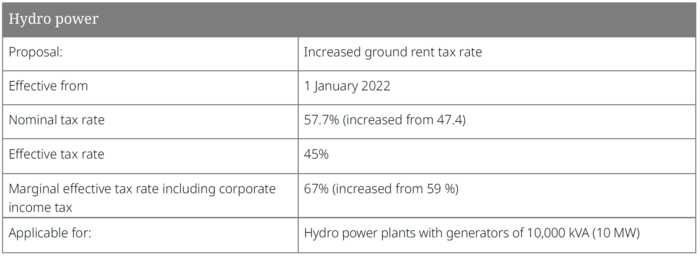

- Increased ground tax rate for hydro power

A ground rent tax is a type of tax that comes in addition to corporate income tax and other taxes. A key difference between ground rent tax and corporate income tax is that the basis for calculating the income under the ground rate tax is generally based on the spot price of electricity, rather than the actual price achieved (with a few exceptions).

Another key difference is that the ground rent tax is proposed structured as a cash-flow tax, as opposed to that of a periodised profit tax corresponding to the current corporate income tax. This generally implies, inter alia, that investments are deducted immediately instead of investments being activated and depreciated over time. This may imply a liquidity advantage for new and recent investments, depending on the specific structuring, in particular if the proposals include the state paying out the ground rent tax value of losses.

In addition to the above the proposals include introduction of natural resource tax and amendments to the production tax rate as an instrument of redistribution of taxes from the state to local municipalities and counties. These amendments are in principle not intended to increase the overall tax burden.

The proposals are expected to be passed by the Norwegian Parliament in connection with the 2023 state budget in December 2022.